June 2019

Feature Article

-

Chapter 22: Should Retailers Get a Second Chance at a Fresh Start?

As a condition precedent to confirming a Chapter 11 plan, Section 1129(a)(11) of the U.S. Bankruptcy Code requires a finding from the Bankruptcy Court that “confirmation of a plan is not likely to be followed by the liquidation, or the need for further financial reorganization, of the debtor or any successor to the debtor under […]

More from this Issue

-

Another Busy Year for Retail Restructuring

I’m honored to have been selected by TMA’s Executive Committee as chair of the Editorial Advisory Board. Together with TMA’s Leadership, we’re underway with some innovative changes to the JCR that should provide a lot of value to our membership and continue to position the magazine as the premier member-focused periodical in the restructuring community. […] -

Inside the Big Tent

The “Big Tent” means a lot of things to a lot of people and continues to define itself in new and exciting ways every day. Our Big Tent is about inclusiveness, meaning everyone has a seat at the table and a voice to be heard, which we encourage and support. Our Big Tent has so […] -

Regional Conferences Raise the Bar on TMA Value

In this year of a more forward-facing TMA, I wanted to recognize and express my gratitude to the leaders and chapters who continue to raise the bar on the value of TMA membership with their development and support of TMA regional conference opportunities. Our regional conferences are near and dear to my heart, having been […] -

Chapter 22: Should Retailers Get a Second Chance at a Fresh Start?

As a condition precedent to confirming a Chapter 11 plan, Section 1129(a)(11) of the U.S. Bankruptcy Code requires a finding from the Bankruptcy Court that “confirmation of a plan is not likely to be followed by the liquidation, or the need for further financial reorganization, of the debtor or any successor to the debtor under […] -

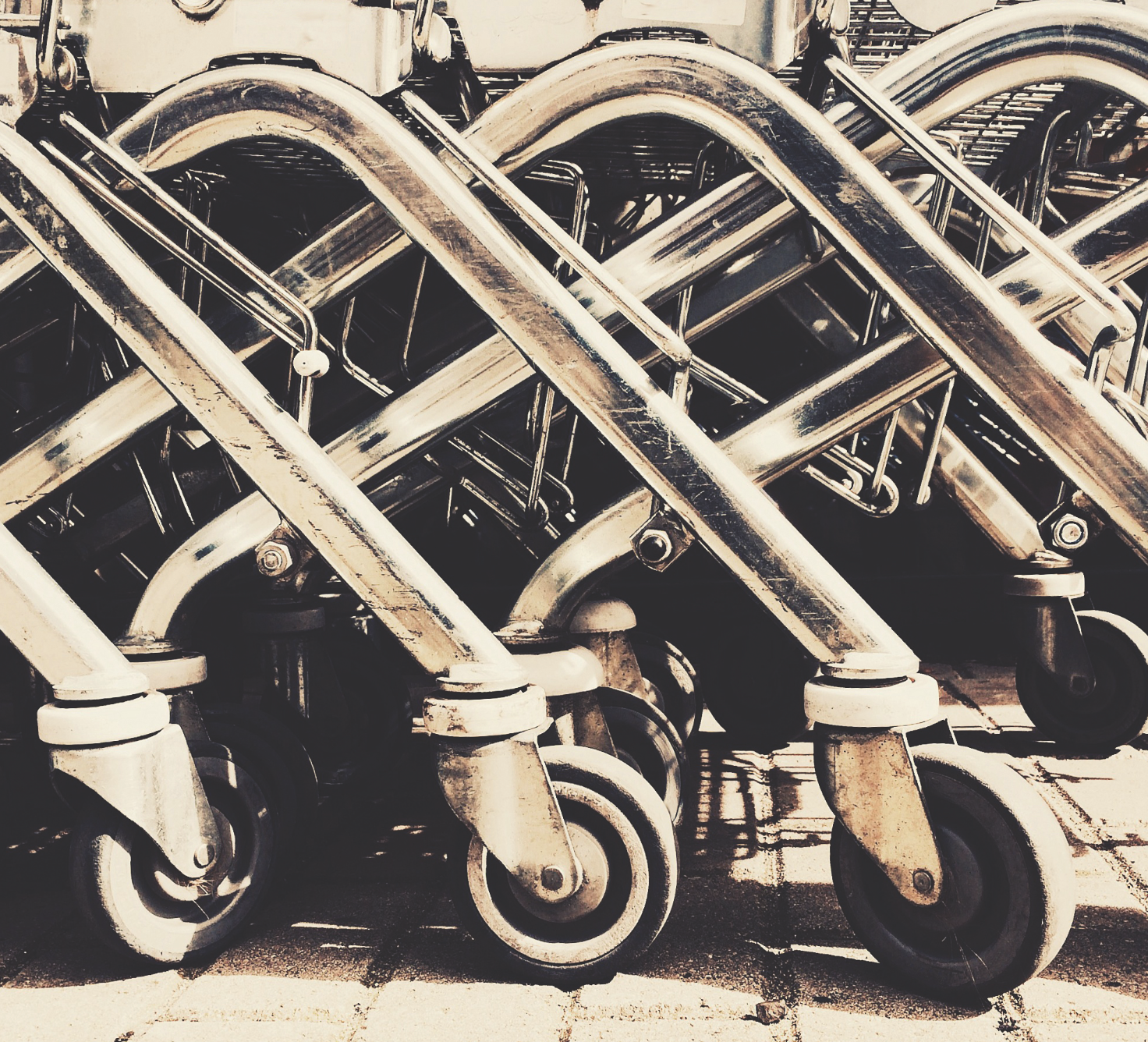

The Retail Apocalypse’s Impact on Grocery Chains

The rise in popularity and convenience of online shopping (i.e., the Amazon Effect) has triggered the bankruptcies of numerous retail consumer goods chains. Since 2015, there have been more than 50 major retail Chapter 11 filings. This trend is due to a number of factors, including (i) the marketplace shift to e-commerce and decline of […] -

Turbulent Seas Continue for Container Shipping Industry in 2019

Last year was a turbulent one for the container shipping industry, but it might just have been a warmup for 2019. Political crosscurrents in the form of trade disputes resulting in new tariffs—and to a lesser extent, the U.K.’s impending exit from the European Union—could rock the industry and add to the already formidable difficulties […] -

Are the Foxes Guarding the Henhouse?

There has been an explosion of bankruptcy filings that were arguably precipitated by leveraged buyouts and private-equity-backed transactions. Two recent examples are Toys R Us and Sears, both of which were saddled with billions of dollars in debt as a result of leveraged buyouts by private equity funds. Those types of transactions are frequently the […] -

Case Study: Restructuring Systemically Important, Multinational Agrokor D.D.

On April 1, 2019, the signs and flags in an industrial area of Zagreb, the capital of Croatia in the South-East of Europe, turned from red to green; the old Agrokor letters on red background were replaced by the new green logo of the Fortenova Group. The date marked the successful end of a restructuring […] -

Recent Delaware Rulings Highlight Chapter 11’s Inherent Flexibility

Congress designed Chapter 11 to be flexible to promote the twin goals of rehabilitating distressed businesses and maximizing stakeholder returns.1 Several recent decisions from the U.S. Bankruptcy Court and District Court for the District of Delaware highlight how Chapter 11’s inherent flexibility promotes these goals. These decisions include: allowing “horizontal gifting” of an undersecured creditor’s […] -

Recent Prepacks Stay True to Chapter 11’s Intent—with a Speedy Twist

On Sunday, February 3, 2019, at 6:52 p.m., retailer FullBeauty Brands Holdings Corp. and nine of its affiliates filed for bankruptcy in the Southern District of New York. In re FullBeauty Brands Holdings Corp., Case No. 19-22185 (RDD) (Bankr. S.D.N.Y.). Less than 24 hours later, FullBeauty confirmed its First Amended Joint Prepackaged Chapter 11 Plan […] -

Goal-Oriented: Pierre Marchand

Pierre Marchand is a partner on the corporate restructuring team at MNP, Canada’s fifth-largest national accounting firm, in Montreal. He has more than 20 years of experience providing financial advisory and restructuring services. In addition, Marchand has served as a volunteer coach for the Association du hockey mineur de Varennes since 2007 and as member […] -

TMA Talks: Building Networks and Finding Mentors

Welcome to TMA Talks, a regular series of podcasts hosted by TMA Global CEO Scott Y. Stuart, Esq. Each segment features prominent TMA members, industry experts, and other special guests. These exchanges, edited transcripts of which are printed in the JCR, offer insights into key markets, forward-thinking economic outlooks, insider thoughts on industry trends, and much more. TMA Talks […] -

Milestones

John Cronin, Fred Raccosta, and Jason Rae have been promoted to managing director at Tiger Capital Group. Cronin has more than 20 years’ experience in both the liquidation and appraisal businesses and since 2012 has been the firm’s director of planning & analysis. Raccosta, a 28-year veteran of the valuation advisory and asset-based lending industries, […] -

Newcomers: June 2019

Arizona Holly E. Daetwyler, MCA Financial Group Ltd. Atlanta Guy Camerlengo, Huntington Business Credit Geoffrey Samuels, Commercial Funding Inc. California – Northern Shirley J. Daniel Philippe A. Poux California – Southern Marco Simmons, Wells Fargo Capital Finance Jake Thomas Carolinas Becky P. ODaniell Matthew Owings, HVB Capital Chesapeake Charles J. Brown, Gellert Scali Busenkell & Brown LLC Chicago/Midwest Linda T. […]